Weekly Crop Commentary - 05/02/2025

May 02, 2025

Haylee VanScoy

Director of Grain Purchasing

Grain markets have found a bit of footing this week as funds appear to be stepping back in following month-end position squaring. Export sales came in within expectations across the board, with all three major commodities tracking about 2% ahead of the pace needed to meet USDA targets. Of the 39.9 million bushels of corn sold, Mexico remained the top buyer, while China led the way on bean purchases. There continues to be plenty of noise around global trade negotiations, with China dominating the headlines—publicly taking a hardline stance against the U.S., yet quietly making strategic exemptions behind the scenes for key imports they rely on.

South American weather has been mostly cooperative, with no major issues impacting Brazil’s first corn and bean harvest or its second corn crop nearing maturity. Domestically, heavy rains have drenched parts of the south, including Oklahoma and Arkansas. Most of the Corn Belt remains free of drought concerns, and the 7-day forecast looks dry north of central Illinois and Iowa. Here in Ohio, the northern part of the state has missed much of the rain, allowing for solid planting progress, while the southern half has been slower to roll. It’s still early, with plenty of time left in the season.

Wishing you all a great weekend—stay dry, and enjoy Derby Day tomorrow if the weather cooperates! And on a personal note, we’ll be celebrating my son’s 1st birthday—hard to believe how fast a year has gone by!

Briana Holtzman

Grain Merchandiser, Kenton (Region 1)

It was a fairly quiet week for the grain markets. There was mention of China potentially having talks with the United States, but it was never confirmed. Beans have been lacking a good story, as China negotiations are dragging, South America is harvesting a large crop, and the EPA policy about biodiesel was not released last week as anticipated.

Hopefully, everyone is finding the time to get in the field planting, while dodging this inconsistent rain. It’s already May! In our downtime, let's get back to thinking about some target offers for new crop wheat, corn, and beans!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

It's now go time to get the crop in the ground. We just need the weatherman to help us out. I did see a little work done in my area this week, but for the most part, the rain kept everyone out of the fields. If the forecast is correct, we should see good progress over the next 10 to 14 days.

The corn market continues to pull back from its run-up in early April. Today, the market is not worried about having enough corn. We are trading 96 million acres with trend-line yields, so that would have a carryout around 2 billion bushels. Until we see a reason not to believe that, this market will most likely work sideways or lower over the next few months. If we end up with this happening, 4.00 come harvest time will look like a home run.

Soybeans are just moving sideways at this point. The market knows we have plenty of soybeans available today because of the big South American crop. The question will be how many acres we end up planting here in the U.S., and what our yield is. We do not have a lot of room for error here, but with good stocks around the world, I don’t know if it matters.

As always at this point, if you can see your crop growing, it would be a great time to start getting some sales on as we move into the summer. Remember, the market will not wait for you to make a decision.

Ralph Wince

Grain Merchandiser, Marysville (Region 4)

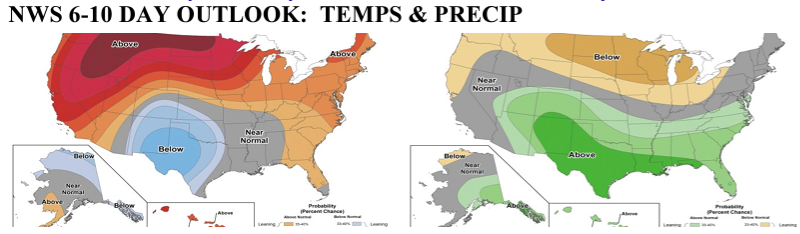

Good afternoon. The corn and soybean market continues to show us some up and down movements again. With tariff fears in the marketplace, we continue to see the uncertainty with traders in the grain markets as well. Planting progress started the season on pace, but Monday’s progress numbers may show that this week we did not see as much get done. A big portion of the Midwest saw a number of rains this week. It does appear, though, that we are headed into drier weather patterns moving forward. Below, I have inserted the latest 6-10 day maps. The 8-14 maps pretty much show the same. That would make one think that we will see a lot of progress next week.

It does appear that China may be willing to start talks with the U.S. on the tariff front. That doesn’t mean that we will see things get done at a fast pace. China’s President Xi Jinping has to make sure that he does not appear to be the one showing weakness amongst his people, but the bottom line is that this tariff situation is hurting China’s economy in a big way. China has already had to shut down some factories because of the tariff war, and that is causing its debt to grow. The Chinese government has been injecting money into its economy to help keep it propped up. As negotiations move along, it will not be fast progress, but it will be a step in the right direction.

Lastly, there continues to be talk about a high-pressure ridge that could set up over the mid-section of the country as we move into late June & July. It is somewhat dependent on what the water temperatures are off the Alaskan coast. We will continue to monitor that story as we move into the growing season. Make sure that if something like that does present itself, you are ready to take advantage of any market upticks. Have a great weekend and be careful as you go to the fields to get this crop in the ground. Lots of people depend on each of you, so don’t try to cut corners because of time constraints. Your life is more important than that.